Heat Pump Tax Credit 2024 Texas Form – Get expert advice on improvements to your home, including design tips, how much you’d expect to pay for a pro and what to ask when hiring experts. . Tax Code § 171.1013(c); Tex. Tax Code § 171.006; and 2024 Texas Franchise Tax Report Information and Instructions Form 05-913 (Rev. 9-23). New veteran-owned businesses are no longer required to .

Heat Pump Tax Credit 2024 Texas Form

Source : www.forbes.comFederal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.govMissouri Solar Incentives, Tax Credits And Rebates Of 2024

Source : www.forbes.comFederal Solar Tax Credit (What It Is & How to Claim It for 2024)

Source : www.ecowatch.com2024 renewable energy industry outlook | Deloitte Insights

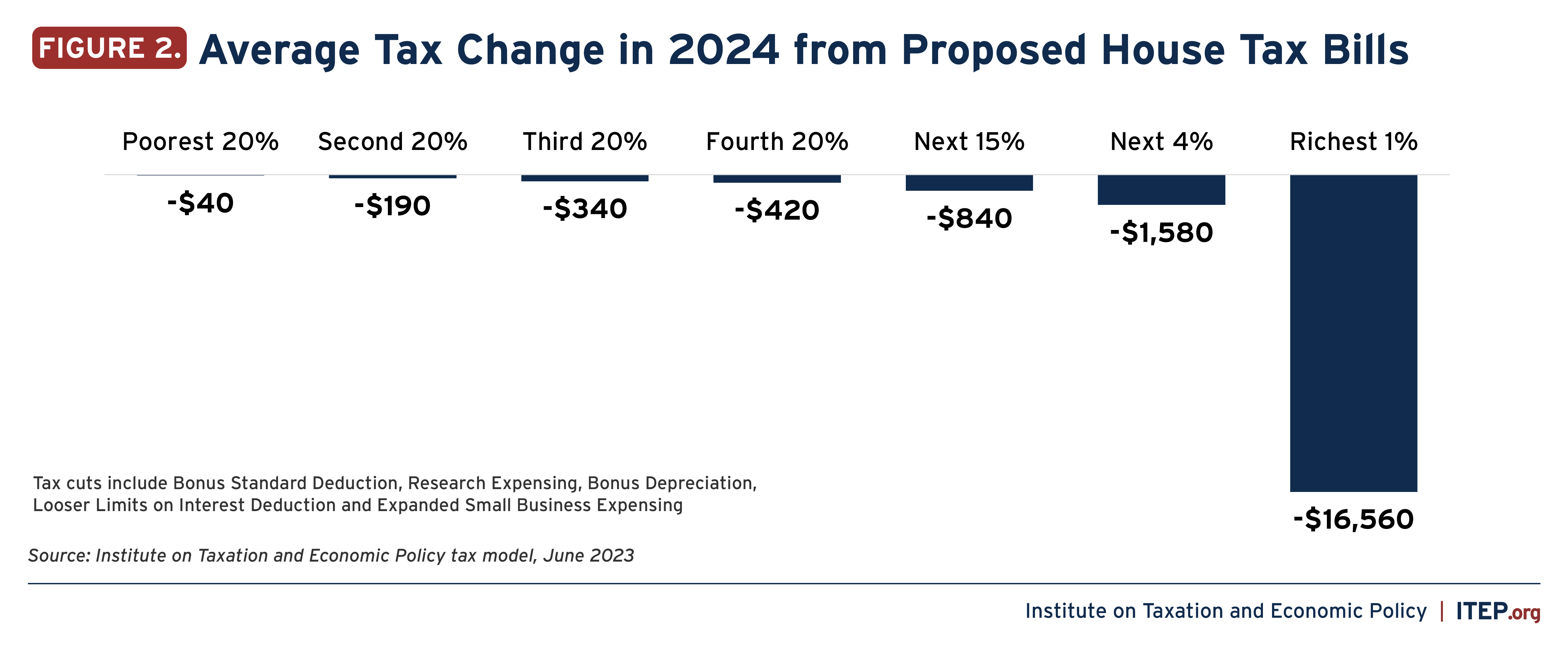

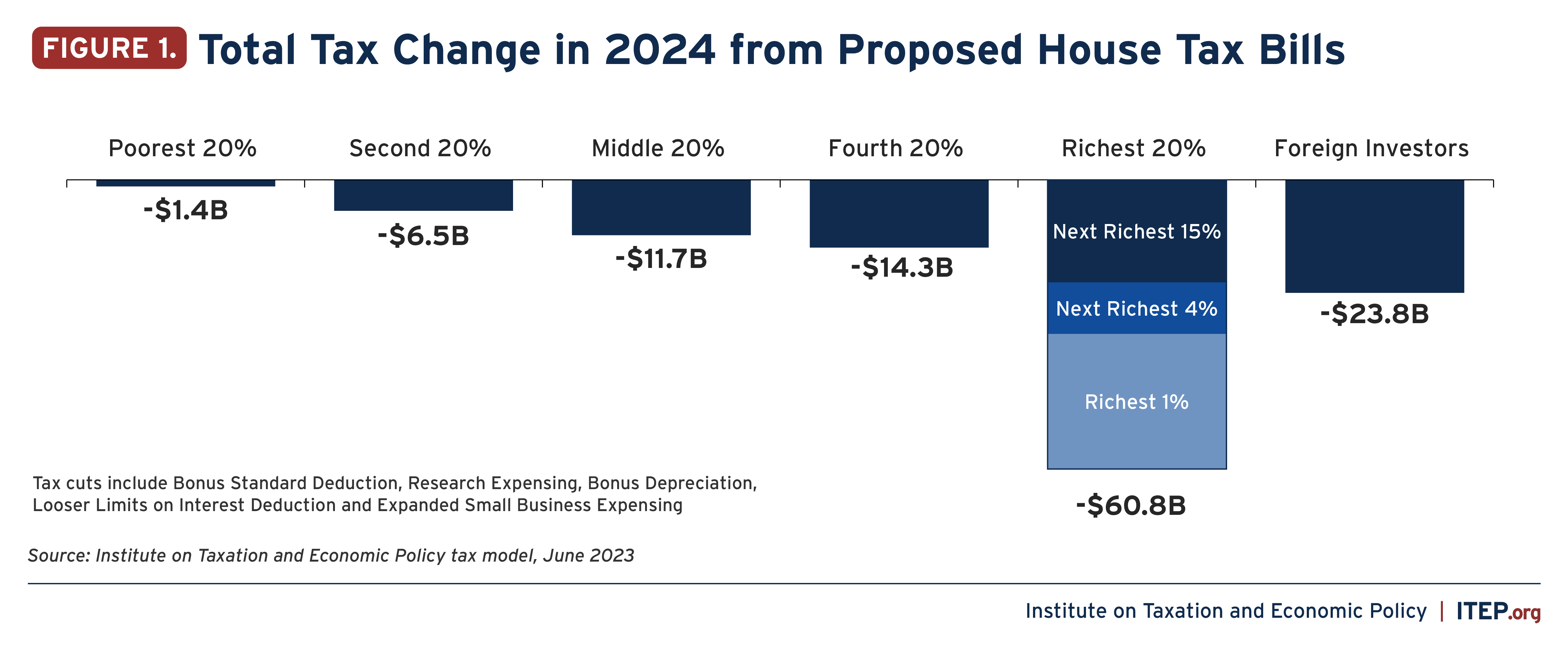

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.orgComplete Guide to the 2024 Federal Solar Tax Credit

Source : www.solarreviews.comFederal Tax Credits for Air Conditioners & Heat Pumps [2023]

Source : kobiecomplete.comElectric Vehicles: EV Taxes by State: Details & Analysis

Source : taxfoundation.orgTrio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.orgHeat Pump Tax Credit 2024 Texas Form Federal Solar Tax Credit Guide For 2024 – Forbes Home: Heat pumps are a well-established technology. Now they’re starting to make real progress on decarbonizing homes, buildings, and even manufacturing. Daikin, Mitsubishi, Viessmann Now We’ve . The typical price range for a heat pump installation is $4,200 to $7,600, with an average of $5,900.* A heat pump is a sleek, efficient, and cost-effective way to heat and cool your home. .

]]>